Why Insurance Companies Use Microsoft Dynamics CRM to Stay Competitive

Posted on: July 15, 2020 | By: Guy Logan | Microsoft Dynamics CRM

The relationship between data and the insurance industry can be more than complex. Being able to manage, control and secure data in a valuable way that still meets all security and regulatory requirements leads to numerous challenges. For example, keeping up with new requirements while maintaining compliance with previous regulations can be time-consuming and expensive without the right knowledge or tools in place. And with the impact of the COVID-19 pandemic on the insurance industry, it has become crucial to cut costs and improve company efficiency to survive. To start tackling these challenges, insurance companies need the tools of technology to help.

In this blog post, we’ll be exploring the intricate relationship between data and insurance, and how you can start managing your data more efficiently with Microsoft Dynamics CRM.

The Challenge with Data in Insurance

Data is the primary driver of the insurance value-chain. It’s used to assign and monitor risk, and it can be used to track customer interactions. However, data can also be extremely costly. To start, there is the cost of maintaining data in any system like a hard drive. Then, there’s the cost of moving data. And for data held in older formats, you may need to transition it to a newer format, leading to even more costs.

For example, historical data, or data collected over long periods of time, can be a valuable resource for an insurance company. But the problem with historical data is the cost of normalization. Unless the data is transformed into a modern, shareable format, it remains isolated from the rest of your insurance operations. This means that it cannot be used to its full potential, and provides no information on how to improve your company operations.

Increasing digitization of human behavior has also impacted data processing for insurance companies. Data from wearable devices like FitBits can help to build geographical-based risk scores. However, these sources send data at different frequencies and levels of efficacy. The amount of data available in such a digital world can be extremely overwhelming for most insurance companies.

Additional elements of data can be generated by customers for many reasons as well. For example, new data comes as policy features change or new controls are added. Insurance companies then must face the challenge of regulation control. This means maintaining compliance with existing regulations and continually adding new ones can become extremely expensive and time-consuming.

Cutting Costs with Microsoft Dynamics CRM

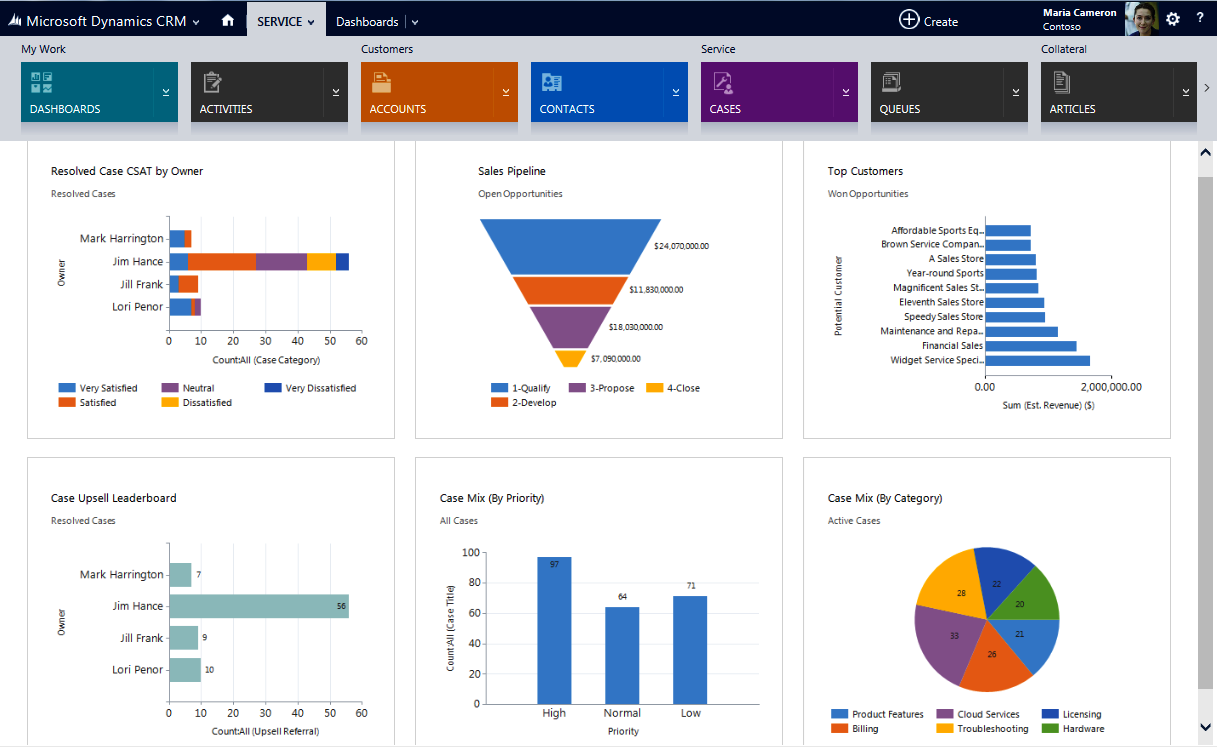

It is clear that the relationship between data and insurance can be complex, especially with the different costs and regulations imposed on the industry. The complexity and scale of these problems mean automation and the constant evolution of software solutions are a necessary solution. Microsoft Dynamics CRM can help you manage and maintain customer relationships, track sales leads, and deliver actionable data. It is the ultimate tool of integrated, data-driven software solutions that improve how you interact and do business with your customers.

Microsoft Dynamics CRM provides a security model that supports efficient data access and collaboration while protecting the data as well. For example, security can be leveraged based on the role and tasks performed by a user or a team. The Team Leader role can be configured to export data out of CRM, an Executive role can be modified to access all data in the system, and more. This means people across teams can share and collaborate quickly with data while maintaining privacy based on their role in a client project.

Using a singular platform to keep track of customers with an excellent reporting functionality can allow your company to gather data and assess situations in real-time. Microsoft Dynamics CRM provides an app that can be implemented on both your phone and tablet. Users can view, update, and add data to your CRM system on the move, which can help to increase productivity even when remote.

There’s no need to stress about standardizing or normalizing data formats when your CRM system is capable of automating such processes. Delivering risk models can be faster, more efficient, and cost effective through the power of a CRM system. Microsoft CRM provides computing processes that run data and risk models with more control, and let you leverage the cloud for optimal compute capacity.

Next Steps

Microsoft is constantly inventing new tools and services like Microsoft Dynamics CRM for insurance companies. Partners like Logan Consulting innovate with the same devotion to solve such problems. Talk to us to learn more about how you can start improving business results and tackling challenges today.