What is M&A technology integration?

Mergers and Acquisitions are all about synergy – whether cost savings or strategy support –information technology is most likely instrumental in achieving this.

- Synergies correlate strongly with the financial success of a merger.

- When a deeper technology due diligence process is conducted, it has a direct correlation with post-deal synergies.*

IT due diligence is fundamental for post-merger synergy. It prompts the early identification of potential synergy issues, empowers business executives to make better projections on realizing synergies and it supports the collaboration of business leadership and IT in determining an effective integration strategy.

Without IT due diligence, certain risks such as — integration barriers, long lead times, deal-breaking costs and contract noncompliance — are not likely to be identified. Learn more here at Logan Consulting.

* Recent study conducted by major consulting firm

In the pre-merger phase, a successfully planned and initiated sound M&A integration strategy should be implemeneted. This includes the understanding of operational, technology, and cultural issues. Thus is vital and necessary to assure the value of attaining projected targets.

Once the deal is closed, the challenges magnify. During the post-merger integration phase, integration teams are forced to immediately unlock different functions, processes, systems and cultures. They are expected to do this all while maintaining business momentum, reacting to day-to-day business needs, and maintaining integration speed without negatively impacting the business.

In the pre-merger phase, formulating the proper budgets and assigning the proper resources for the integration will allow teams to work effectively together without the disruption of cut-backs or team reassignments. Misses in these areas are normally seen well after the integration project has started and normally results in delays and uncertainties.

Improper budgeting can create serious disruption to project timelines and result in miss-aligned focus on less expensive and less needed priorities. Thus creating synergy misses, financial issues and executive frustrations. It also can result in board confidence issues as executives go back to obtain additional project funding.

Assigning the wrong resources to the integration project can create issues for the existing business and the new business, as resources try to manage more than capable, or deliver on activities they do not have the skills to complete.

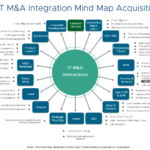

M&A integration plans are a complex and multidisciplinary involving all aspects of the business including technology, operations, HR, legal, tax, finance or accounting.

The great majority of M&A transactions fail post acquisition due to improper integration management, lack of management strategy or because of lack of execution due to poor management. Post Merger Integration Projects cannot be treated or considered normal projects, they are a very complex project environment, which requires integration acumen and experience.

Much different than the standard operations project, many top executives and team members are not prepared well enough for what is coming. Successful merger and acquisition integrations have been considered an art and science to execute properly.

Formulating a strategy is a difficult task. Making strategy work—executing or implementing it throughout the organization—is even more difficult.

Even if you get the strategy and due diligence 100% right, any integration is still subject to a multitude of failure factors.

Execution considerations to remember:

- Planning and execution are interdependent

- Execution requires the correct timing

- Execution requires many people

- Effective execution involves people across all hierarchical levels

- Change is hard to manage

- Use a logical approach to execution

You have to get down to the “art and science” of M&A integration…the essential principals to instill into your M&A integration team

While deals aim to take advantage of the synergies between two companies, benefits are significantly reduced when the Information Technology group is not aligned with the business goals.

An effective IT Strategy needs to be constructed to align with the business objective of the future company, so to make sure that IT enables the new business and allows synergies to be realized timely.

In many cases new companies have fully functioning IT Departments; however the strategies, principles, and objectives are often miss-aligned and this can prevent the new business from achieving its synergies and future optimizations.

IT organizations should be properly structured and aligned to achieve the new strategic objectives and targets.