Negative Net Book Value and Positive Depreciation for Fixed Assets in D365 Finance

Posted on: November 30, 2022 | By: Christopher Rusing | Microsoft Dynamics AX/365

Although it is not common, there might be legitimate reasons for why a fixed asset would have a negative net book value. In some instances, government funds may require that the funds are recorded as a negative value asset, which is then depreciated with positive depreciation. Another example would be if you were migrating fixed assets from a legacy system that allowed negative acquisition costs as a substitute for the ability to adjust the cost basis of the asset after it has been acquired. This functionality would also cover that scenario. The option to allow negative net book value has been available in D365 for quite some time, but until this year, the system did not have the ability to generate positive depreciation from a depreciation proposal to address this issue. The flag to calculate positive depreciation is available if the acquisition costs are negative and the dependent flags are flipped to Yes. The positive depreciation will result in a reversal of accumulated depreciation and depreciation expense as the asset reaches a net book value of $0. Let’s show how this can be executed in D365.

In this example, we can see that the book for this fixed asset has the following settings set to Yes– allow net book value higher than acquisition costs, allow negative net book value, and calculate positive depreciation. The first two tabs must be selected to Yes prior to making the last one available to select to Yes. Once we have all three of these settings changed, we can post an asset with a negative net book value.

The voucher for the acquisition transaction credits the fixed asset ledger account, which allows the negative net book value.

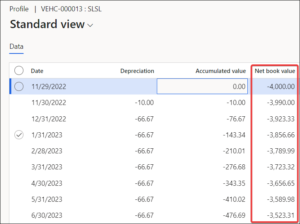

Once the fixed asset is acquired, it will allow for positive depreciation with the flag set to Yes. The net book value in the profile of the book shows it increasing (based on depreciation profile) towards $0.

Lastly, we have a screenshot of some depreciation transactions showing a debit to accumulated depreciation and a credit to depreciation expense.

As you can see, this feature is easy to configure and use! If you are looking for additional information about D365F&SCM, please feel free to reach out to us at info@loganconsulting.com or (312) 345-8817.

All the best!

Logan Consulting