3 Credit Control Features within Acumatica

Posted on: November 16, 2023 | By: Page Wildridge | Acumatica

Acumatica offers a variety of tools to help businesses manage receivables, reduce bad debt, and increase cash flows. This article explains three key features.

Credit Verification Rules

Acumatica allows you to define credit verification rules within customers. The rules will prompt the system to automatically flag a transaction that violates the customer’s credit terms.

Ensure that Hold Documents on Failed Credit Check is selected on the Accounts Receivable Preferences (AR101000) form. This ensures that users are not able to release invoices or debit memos for customers where the credit verification rules are not met.

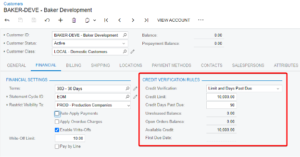

You can define credit rules by customer class on the Customer Classes (AR201000) form. If needed, you can override the default rules for individual customers within the Customers (AR303000) form.

3 options exist for Credit Verification on the Customer Class or Customer setup:

- Credit Limit – If a customer’s outstanding balance exceeds their credit limit, the system puts new documents on hold.

- Days Past Due – If a customer has exceeded their due date based upon their credit terms and credit days past due, the system puts new documents on hold.

- Limit and Days Past Due – Both of the above rules are applied.

Dunning Letters

Acumatica allows for out-of-the-box dunning letters to be generated and sent to customers. Dunning letters notify customers of past due balances.

First, enable Dunning Letter Management feature in the Enable/Disable Features (CS100000) form.

Define the appropriate option in the Dunning Process in the Accounts Receivable Preferences (AR101000) form. The following options are available to view the history of dunning letters that have been produced:

- Dunning Letter History by Customer (AR408000): Shows the history of dunning letters that have been produced for the selected customer account.

- Dunning Letter History by Document (AR408500): Displays the history of dunning letters that have been produced for documents of the selected customer account.

You can define the list of dunning letters in the Accounts Receivable Preferences (AR101000) which can be overridden on the Customer Classes (AR201000) form.

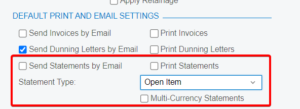

You can exclude a customer from receiving dunning letters by clearing both the Send Dunning Letters by Email and Print Dunning Letters check boxes in the Print and Email Settings section on the Billing tab of the Customers (AR303000) form.

The Prepare Dunning Letters (AR521000) screen is used to generate dunning letters for customers.

The Dunning Letter (AR661000) report is the default dunning letter format used in Acumatica.

Customer Statements

Customer Statements can be automatically generated to notify your customers of outstanding balances or can be used by your customers to reconcile their month-ending balance with yours.

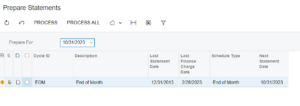

Define Statement Cycles (AR202800) which define the frequency of which statements are generated.

Statement Cycles are assigned in the Customer Classes (AR201000) form. If needed, you can override the default statement cycle for individual customers within the Customers (AR303000) form.

The statement type on the Customer Class also defines which documents display on the statements. There are 2 options:

- Open Item – the statement prints only documents open through the statement date.

- Balance Brought Forward – the statement prints all documents that were posted during the statement cycle.

Here, the email and print settings for statements are also defined.

Use the Prepare Statements (AR503000) screen to prepare customer statements for some or all cycles.

Use the Print Statements (AR503500) screen to print or email customer statements in bulk. Statements are then automatically marked as “Printed” or “Emailed”.