Creating Fixed Assets in QAD

Posted on: April 19, 2022 | By: David Kwo | QAD Financials

Overview

Fixed assets are large capital purchases which companies record as assets that depreciate over time (instead of expensing the cost). Companies can use fixed assets to make large investments in capital purchases that are used in production of its goods and services. Fixed assets allow companies to make purchases that do not result in a large impact on their income statement in the first year. Instead, the cost of the asset is capitalized over its useful life. While companies may use third-party systems or Excel to keep track of fixed assets, QAD provides users with the capability to implement these processes within the same system.

There are numerous advantages to tracking fixed assets in the QAD system:

- Assets are likely being purchased within QAD. This allows us to use the same system for recording the purchase as well as maintaining our assets

- The Fixed Asset module in QAD is highly configurable to meet many organizational needs

- There is no additional cost to adding fixed assets to an existing QAD system (as opposed to paying for a third-party system or application)

Creating Fixed Assets

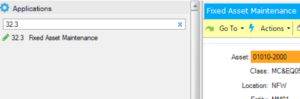

Step 1: Create a new fixed asset in Fixed Asset Maintenance (32.3)

- Click Add to create a new asset

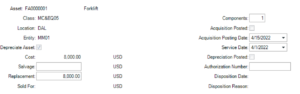

- Populate Fixed Asset header with:

- Asset ID – This can be setup to be auto-assigned by a number sequence or manually entered (Up to 12 alphanumeric characters)

- Description – Free-text description of fixed asset

- Class – The most important piece of setup. The class determines the default useful life, depreciation method, and the depreciation books associated with the asset – Setup in Class Maintenance (32.1.17)

- Location – Physical location where asset exists – Setup in Fixed Asset Location Maintenance (32.1.13)

- Depreciate Asset – Set to Yes for any asset that needs to be a part of our balance sheet. If set to No, the cost of the asset will not be posted to our GL

- Cost – Total cost of the fixed asset

- Acquisition Posting Date – The date the acquisition of the asset will hit our general ledger.

- Service Date – The date the asset was placed into service. Determines our depreciation schedule moving forward.

- Review Depreciation Books

-

- Depreciation Books define how the asset will be depreciated, its useful life, and the depreciation method which will be used

- An asset must have at least one Depreciation Book, but we can associate an unlimited number of books with a single asset for different purposes.

- In this example, we have a GL and a tax book which depreciates the asset with different useful lives and methods

- With the Book selected, click Audit to view a period by period breakdown of the asset’s depreciation.

- In this example, we have a GL and a tax book which depreciates the asset with different useful lives and methods

Step 2: Add acquisition details in Options screen

- Click Option

- Click Update

- Add any additional acquisition details about assets, comments, or warranty information

- As an aside, we also can split assets by component

- This can be useful if there are multiple components that roll up into a single, parent asset

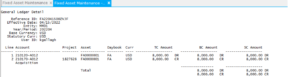

Step 3: Add cost to General Ledger (optional)

- Once the user is finished entering details, the system prompts us to indicate whether the acquisition of asset should be posted to the General ledger

- If Post to GL = Yes, a GL transaction will be automatically created to record the cost of the fixed asset

- If the cost of the asset is already recorded in our GL (through a PO), set this field to No to avoid double-booking the acquisition cost.

- If Post to GL = Yes, a GL transaction will be automatically created to record the cost of the fixed asset

- Note: This transaction creates an unposted operational transaction, use Operational Transaction Post to officially post the acquisition to the general ledger

- In the General Ledger Detail, we can see the accounts the acquisition was posted to, which are defaulted based on the asset Class but can be updated on an individual asset.

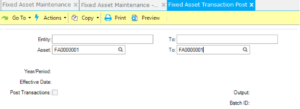

Step 4: Post First-Month Depreciation

- Each depreciation period, an unposted journal entry is created to record depreciation expense

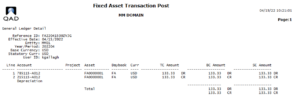

- To officially post to the GL, navigate to Fixed Asset Transaction Post (32.13)

- Optionally select a range of entities or assets to post transactions for.

- If no filter criteria is selected, all unposted GL transactions will be posted.

- Enter the effective date the transactions should be posted on

- Set Post Transactions to No to review the transactions to be posted.

- Set Post Transactions to Yes to officially post to the GL

- Above, we can see the first month of depreciation booked to our depreciation expense account defined on the asset record.

- This process should be repeated monthly to review and post fixed asset transactions

- Note: In addition to depreciation expense, transactions such as fixed asset retirements and changes to the asset record (useful life, cost, depreciation method) will also be posted to the GL via the process above.

Next Steps

If you are interested in learning more about Fixed Assets in QAD and/or maximizing the use of your QAD system, contact us here to find out how we can help you grow your business. You can also email us at info@loganconsulting.com or call (312) 345-8810.