How to Track Insurance Agent Licenses and Skill Levels with Microsoft D365 CRM

Posted on: February 8, 2021 | By: Guy Logan | Microsoft Dynamics CRM

The Insurance Industry is heavily regulated, and most states require Insurance Agents and Brokers to be licensed. Keeping track of these licenses is a common function of agency management, particularly if an agency is operating across various states or in states with multiple licensing. At Logan Consulting, we have ample experience in configuring and customizing Microsoft Dynamics 365 CE (CRM) to include effective Licensing requirement handling.

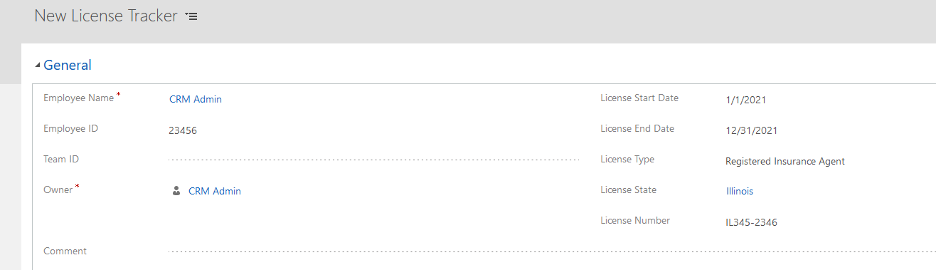

Microsoft Dynamics CRM includes the most important key features: Agent name, License type, License State, and expiration dates. These features can also be customized to add information such as State License Bureau information, Detailed License Types, and more. Automation can be applied to create alerts or notices about expiring agent licenses, and this information can be applied to a dashboard to enable easy access to and management of licensing processes.

Reporting is flexible, and the end-user can change parameters to provide:

- Upcoming expiration reports for 30, 60, or 90 days out.

- Licenses by Agent.

- Missing or expired licenses.

- Exporting to Excel for further analysis.

In addition to tracking licensing requirements, it is also important to track and report on agent product knowledge and skills. Like license tracking, product and skill knowledge tracking is also built into many Insurance Engagement Systems that Logan Consulting provides for our clients. Furthermore, we have advanced expertise in applying Agent Product knowledge information to automate the selection of Agents to match client requests for specific policy type information or first meetings.

Consider the following scenario of a true digital transformation:

An agency’s internal call center is responsible for reaching out to prospects and scheduling appointments with potential clients for health insurance. The meetings can be virtual, in-person at their home, at the Agent’s office, or even at a third-party location such as the local Starbucks. During the call, the booking agent determines what type of product the prospective client would be interested in and chooses possible dates for the meeting. The booking agent inputs this data into their scheduling system that is part of their D365 CRM platform, which immediately provides dates and agents available in the area with the relevant product knowledge (based on the agents’ internal training and types of policies the prospect is interested in). The call center agent immediately books the appropriate sales agent for an appointment with the prospect. The Prospect receives a text with the appointment time, date, and agent name.

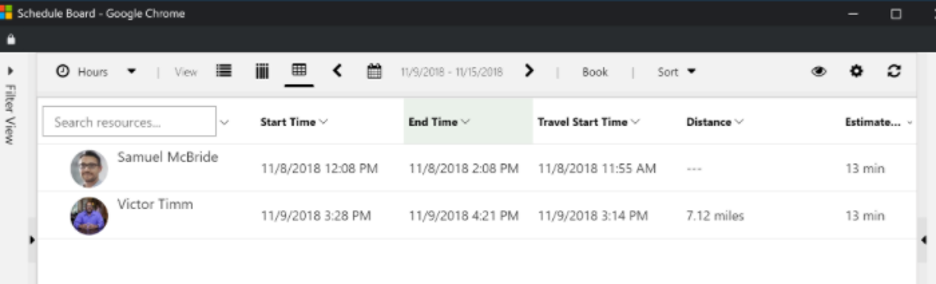

The Sales Agent is provided with all the information required to attend the appointment on their phone or laptop: Date, meeting time, prospect name, address, product type, and even travel time and distance from their current location.

Once the Sales Agent completes the appointment, they can immediately update the prospect record to indicate if a policy was sold, complete an application and upload for processing, and update sales reporting information for the agency — all in near real-time in one seamless operation.

Next steps

The above scenario is a prime example of how Logan Consulting can help insurance agencies achieve digital transformations by optimizing their agency operations. If you are interested in growing your business with a modern digital platform, contact Logan Consulting today and let us show you how we can help.