Dynamics 365 for Financials – Closing the Books

Posted on: July 5, 2017 | By: Jim Bertler | Microsoft Dynamics Business Central

The process for closing the book includes these main tasks:

-

Closing the accounting period:

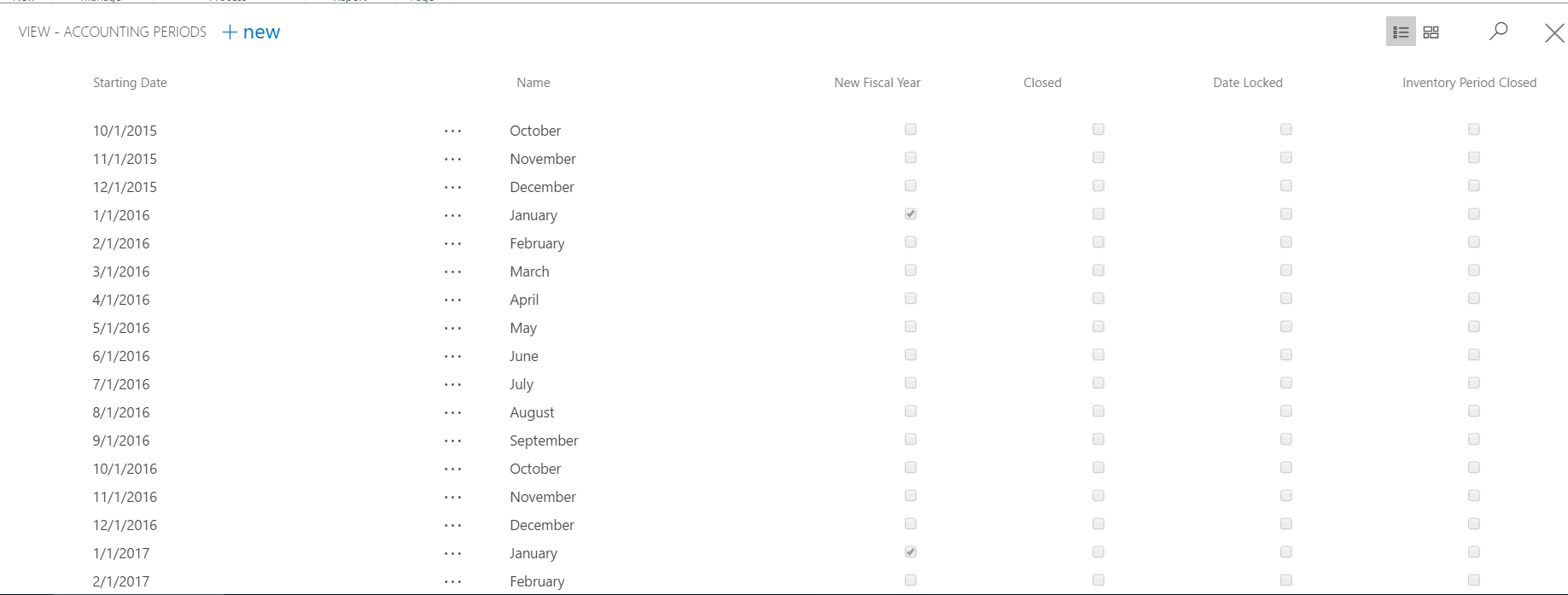

A fiscal year is defined as one or more open periods as defined in the Accounting Periods window. A typical fiscal year contains 12 periods of one month each, but you can also choose another method of defining a year.

2. Registering prior-year entries:

When you a fiscal year is closed, several administrative transactions (such as prepaid and accrued items) must be entered. These transactions are called adjusting entries. There are no special rules for posting these entries, and they (like other entries) contain a check mark in the Prior-Year Entry field if they are posted on a date in a closed fiscal year. Even though a fiscal year has been closed, you can still post general ledger entries to it.

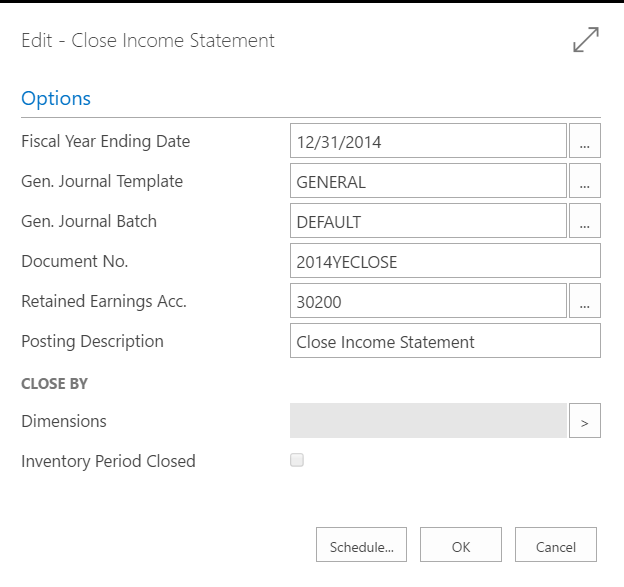

3. Transferring balances from the income statement accounts to the balance sheet:

After a fiscal year has been closed and all prior-year entries have been posted, the income statement accounts must be closed and the net income for the year must be transferred to an account under owners' equity on the balance sheet. Use the Close Income Statement batch job for this purpose. The batch job processes all general ledger accounts of the type Income Statement and creates entries that reverse their balances. These entries are placed in a journal from which they can be posted. The batch job does not post them automatically, except when an additional reporting currency is used. When an additional reporting currency is used, the batch job posts directly to the general ledger.

4. Posting the year-end closing entry along with the offsetting equity account entries:

When the Close Income Statement batch job is finished, you post the entries generated by the job. If a retained earnings account was not specified in the batch job, then enter one line with a balancing entry that posts the net income to the correct general ledger account under owners' equity on the balance sheet. Finally, post the journal.

What Happens When the Year is Closed?

When the year is closed, the system moves your earnings from calculated earnings to the Retained Earnings account. The system also marks the fiscal year as “closed,” and marks all subsequent entries for the closed year as “prior year entries.”

The system then generates a closing entry, but it does not post the entry automatically. The user is given the opportunity to make the offsetting equity account entry or entries, which allows the user to decide how to allocate the closing entry. For example, if the company has several divisions, a user can let the system generate a single closing entry for all the divisions, and the user can then make an offsetting entry for each division's equity account.

A user can post in a previous fiscal year, even after the income statement accounts have been closed, if the user runs the Close Income Statement batch job again afterward.

For further insight on Microsoft Dynamics 365 installation and implementation, contact Logan Consulting, your Microsoft Dynamics 365 Partner of Chicago.