Reviews and corrects ledger-to-subledger alignment in D365 by fixing posting configurations, inventory profiles, reconciliation logic, GL mapping, and critical reporting procedures.

Electronic Funds Transfer in QAD

Posted on: October 25, 2021 | By: David Kwo | QAD Practice News, QAD Financials

Electronic Funds Transfer (EFT) is a convenient and simple way to send electronic payments to clients, vendors, or any other unit. Bank drivers are a key component in leveraging EFT; they are the programs that create files in the format that banks require and support multiple electronic funds transfers, including check, Wire, and ACH files

Bank drivers offer several key benefits:

- Helps to ensure financial compliance KPI

- Automation speeds up processing and reduces error

- Reduces financial close cycle time

- The system makes it possible to reconcile payments all in one movement, significantly speeding up the payment and month-end closing processes

- Speeds up payment processing for Day Sales Outstanding and Days Payable Outstanding

- Reduce financial reporting person days

To further streamline the EFT process, Logan recommends that users implement a clearing process, which eliminates the need for a manual process in QAD to check payment reports from banks to verify that payments were accepted. This automated clearing process allows users to turn around payments within minutes as opposed to waiting several days.

The efficient, two-step process is as follows:

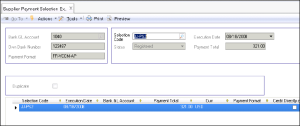

Step 1: Accounts Payable creates a payment file for ACH in Supplier Payment Selection Execute

- Creating file for Clearing Payments

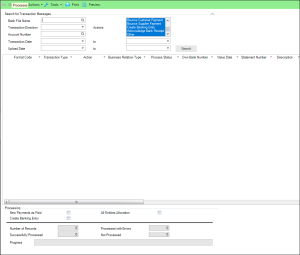

Step 2: Clear ACH Payments from For Collection to Paid in Process Incoming Bank Files

- Bypassing need to encrypt file and move it through QAD, Windows, and bank servers

Next Steps

If you are interested in learning more about Electronic Funds Transfer in QAD and/or maximizing the use of your QAD system, contact us here to find out how we can help you grow your business. You can also email us at info@loganconsulting.com or call (312) 345-8810.