Reviews and corrects ledger-to-subledger alignment in D365 by fixing posting configurations, inventory profiles, reconciliation logic, GL mapping, and critical reporting procedures.

Cash Flow Control in 2026: Turning Microsoft Dynamics 365 Finance into a Near‑Real‑Time Liquidity Engine

Posted on: February 9, 2026 | By: Ashley Xue | Microsoft Dynamics AX/365

Cash flow has always mattered. In 2026, it’s the difference between “we can” and “we can’t.” Volatility turned cash from a monthly metric into a daily operating constraint.

Logan Consulting’s quick take: most organizations don’t have a forecasting problem. They have a control problem. The spreadsheet forecast becomes an emotional support animal—comforting, familiar, and only loosely connected to what’s happening in the business.

The good news: Microsoft Dynamics 365 Finance can behave like a liquidity engine—if you design it as a control system, not a reporting layer.

1) Anchor cash forecasts to enforceable commitments

D365 Finance cash flow forecasting is built to project the future cash impact of transactions that are actually in the system—open transactions and orders—and it can incorporate project-related activity when configured.

That matters because accurate cash forecasting is less about clever math and more about transactional truth.

Where forecasts usually go sideways:

- Payment terms and due-date logic aren’t consistent.

- Terms get overridden on documents “just this once” (famous last words).

- Liabilities aren’t posted promptly, so obligations surface late.

Practical tip: if your forecast whiplashes at month-end, fix data discipline before you blame the model.

2) Keep the forecast current without heroics

A liquidity engine can’t rely on manual refresh rituals. In D365 Finance, the cash flow calculation process can be run regularly and scheduled using process automation so forecasting analytics stay updated.

Practical tip: choose a cadence that matches how fast cash moves (daily for many, at least weekly for everyone).

3) Make payables predictable, not improvisational

Cash pressure rarely comes from one dramatic event. It’s usually death-by-a-thousand “reasonable” payment decisions.

D365 Finance helps you turn AP into a predictable rhythm. For example, payment proposals let you select vendor invoices for payment based on criteria like due date and cash discounts—so payment runs are rules-based instead of inbox-based.

Logan POV: review large purchase commitments weekly alongside the cash forecast. Waiting for invoices is like waiting for the smoke alarm to finish the fire.

4) Make receivables realistic

Revenue recognition doesn’t deposit cash. Customers do.

Finance Insights includes cash flow forecasting that uses machine learning to improve forecast accuracy and support decisions in the context of current cash position.

Customer payment predictions also use machine learning (trained on historical invoices, payments, and customer data) to better predict when customers will pay, helping you identify invoices likely to be late and act earlier.

That changes collections from reactive (“call everyone”) to targeted (“protect next week’s cash”).

Practical tip: track “days to invoice” alongside DSO. A late invoice is one of the few cash leaks that’s 100% preventable.

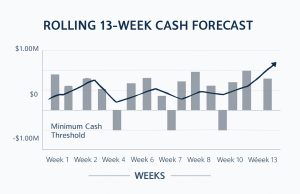

5) Run a rolling 13‑week view and manage by exceptions

A common best practice for short-term liquidity management is a weekly, rolling 13‑week cash forecast—quarter-level visibility with weekly precision.

But the real upgrade isn’t the timeframe. It’s the operating system:

- Weekly refresh of actuals (replace assumptions fast)

- Clear thresholds for cash exceptions (variance, payment spikes, collection slippage, missed invoicing cycles)

- Named owners and required actions (not “we’ll discuss”)

If a dashboard doesn’t change behavior, it’s decoration.

Don’t forget the “outside the ERP” cash events

Taxes, debt service, and one-off items can still blow up a forecast if they’re kept in someone’s head. D365 Finance supports entering or importing external data into cash flow forecasts so you can include those events without maintaining a shadow spreadsheet.

Final thought

The goal isn’t to predict cash perfectly. It’s to stop being surprised by it.

When forecasts are tied to enforceable transactions, refreshed on a cadence, improved with payment predictions, and governed through exception ownership, Dynamics 365 Finance becomes more than a system of record—it becomes a system of control.

A practical Logan-style starting point: pick one legal entity, stand up a 13‑week cadence, schedule the forecast refresh, define the top 10 exceptions that must trigger action, and tighten the transaction rules that feed the model. You’ll learn more in four weeks of operating discipline than in four months of debating dashboards.