Reviews and corrects ledger-to-subledger alignment in D365 by fixing posting configurations, inventory profiles, reconciliation logic, GL mapping, and critical reporting procedures.

Assessing the Impact of Process Improvements with QAD Variance Reporting

Posted on: May 20, 2021 | By: Guy Logan | QAD Financials, QAD Manufacturing, QAD Business Process, QAD Distribution

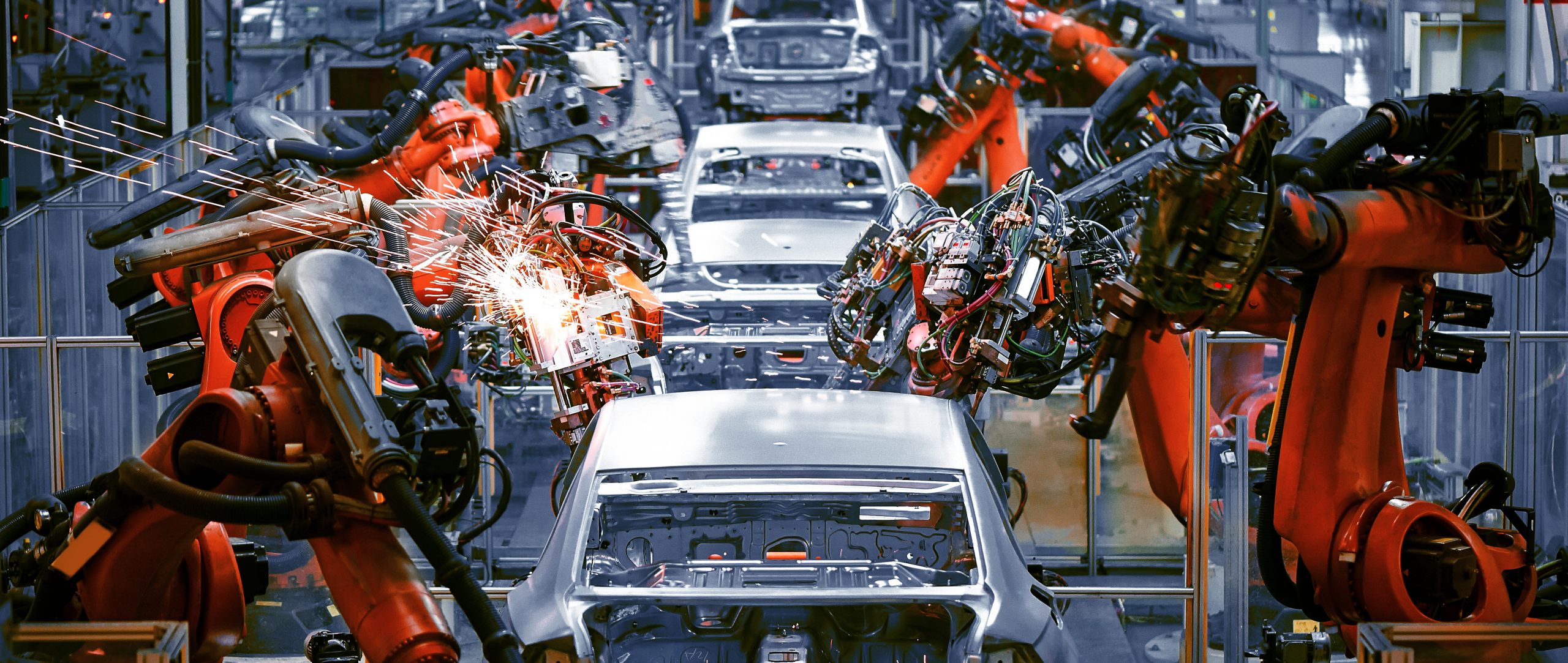

Automotive manufacturing companies typically desire to continuously improve their business processes to maximize revenue. This is often done by generating ideas and forecasting the expected impact to the organization. Understanding how QAD generates variances, and the significance of them, can allow automotive manufacturers to assess the impact of process improvements. This article will review several of the common variances that QAD may generate. We will focus on Purchase Price Variance and Method Variance, and we will discuss what these variances can tell a manufacturer about changes that occurred or need to occur.

Variances Review

Here are some of the variances that QAD may generate.

- Method variance

- Transfer variance

- Material usage variance

- Labor rate variance

- Labor usage variance

- Burden rate variance

- Burden usage variance

- Subcontract rate variance

- Subcontract usage variance

- Purchase price variance

- AP rate variance

- AP usage variance

We’ll only be focusing on Purchase Price Variance and Method Variance, but we’ve reviewed many of the other variances listed on a previous Logan Consulting blog post here.

Purchase Price Variance

The Purchase Price Variance (PPV) for an item is the difference between the procurement price of the item and its standard cost. In QAD, the system calculates PPV whenever the item’s purchase order unit cost does not match its standard cost (GL unit cost). To view the PPV for a certain transaction or a range of transactions, the user can refer to the Receipt Transaction Report. Negative results are considered “favorable” because it signifies a reduction of expense compared to baseline. Conversely, positive results are considered “unfavorable” because expenses were higher than the baseline.

Potential Causes of Purchase Price Variance

There are several potential factors which may contribute to PPV.

If the actual negotiated pricing is not reflected in the standards, then these inaccurate standards are likely to result in Purchase Price Variance. The prices of the purchased material may have increased or decreased due to industry undersupply or oversupply, leading to variance here as well.

There may be temporary causes which result in PPV, such as a rush basis; the increased shipping cost in this scenario will likely generate unfavorable PPV. Another possible cause is onboarding a new supplier; the new cost structure may not yet match the standard cost.

Potential Ways to Reduce Procurement Cost and Unfavorable PPV

Companies may opt to review the terms and discounts they have set up with their suppliers. The company may ask a supplier if there are any discounts the company can obtain by changing its purchasing patterns—purchasing in higher volume, for example.

Credit terms can be seen as a variable which the manufacturer can adjust when negotiating with a supplier to help achieve the predictable pricing the organization wants to see. For example, suppose a company knows that it needs 833 units of an item per month from the supplier for the next 12 months, totaling 10000 units. The company initially asks for a price of $0.99 per unit with Net 30 terms. The supplier may then say it would instead charge $1.10/unit with those terms. To try to keep the cost at $0.99/unit, the company asks for a 10% discount if the payment is accelerated by 15 days (10% 15 Net 30 terms), and the supplier agrees to the terms.

However, it isn’t immediately obvious that opting for the discount would be favorable. Longer payment times mean more working capital, a benefit the company won’t receive when paying 15 days sooner. There is a formula used to compare different term benefits using the cost of capital of a company. The formula first requires the calculation of the payment term benefit for each term, which we calculate with

Payment Term Benefit = (cost of capital / 365) x number of Net Days.

Once the Payment Term Benefit is calculated, the annual spend incorporating the benefit is calculated by:

Annual Spend with Payment Term Benefit = Annual Spend x (1 — Payment Term Benefit).

Let’s assume that the cost of capital of the company is 8%. Then applying the formula to our example gives the following calculations:

Annual spend = $1.10 x 10000 = $11,000

Net 30 terms:

(8%/365) x 30 = .658%

11000 x (1—.658%) = $10,927.67

Discount with 10% 15 Net 30:

(8%/365) x 15 + 10% = 10.329%

11000 x (1—10.329%) = $9863.84

Present Value Cash Impact of Decision: $10,927.84 – $9863.84 = $1,063.84.

This implies that, in this case, it would be financially favorable for the company to opt for the discount. By choosing to opt for the 10% reduction, the company pays a more favorable price and achieves a predictable pricing structure which can lead to reductions in unfavorable PPV.

Reviewing stock levels before ordering is another way to potentially reduce unfavorable PPV because this practice ensures that the company is purchasing at the appropriate times and quantities. Materials Requirements Planning (MRP) systems, such as the one within QAD, will greatly simplify these efforts. These systems will regulate the purchasing activities and will schedule deliveries when needed. The regularity can help the company create an effective production schedule, and this plan can be used in the negotiations with suppliers (like in the example above) which again can result in predictable pricing and hence a lower PPV. For example, the MRP system helps the manufacturer in the previous example decide that it needs 10000 units of an item per week. This knowledge allows the company to negotiate with the supplier based on this schedule. This ensures the buyer doesn’t order too much inventory, which increases carrying costs, or perhaps too little, which could lead to ordering more units on a short notice to compensate, potentially leading to higher costs than expected and therefore higher PPV.

There are also several risks that can increase the likelihood of increased procurement cost. One risk is inadequate needs analysis, meaning that the business does not have an accurate plan of how much of an item it needs and when it needs it. In these circumstances, the business can no longer expect to achieve the consistent pricing that it wants from its suppliers. This could be due to factors we mentioned earlier; for example, being undersupplied could mean additional purchases are made on short notice, at which point the price could raise and PPV could occur.

Companies also introduce risk when increasing purchase volume to obtain better pricing. If the inventory turns of the product using the purchased materials are slow, carrying cost could exceed the savings due to the favorable pricing obtained from the increased volume, resulting in an unfavorable financial outcome for the business.

Another risk is supplier dependence, one of the largest risks a company can encounter. Companies will often ensure the procurement process does not depend on a single major supplier. This is because once the manufacturer becomes too dependent on a single supplier, the manufacturer takes a weak negotiation position. There is less motivation for the supplier to improve their offer, so the company may have to settle for a higher cost than what they would have paid otherwise.

The Importance of PPV

One of the primary reasons for tracking PPV is that it allows companies to monitor how close their actual costs are to projections. If a company is making these measurements, then it allows for improvement in this area as well.

To protect the margins, the company can determine why such a variance occurred. Do changes need to be made in the procurement process? Perhaps prices in the market for the material are increasing, resulting in the variance. Was there a one-time occurrence that resulted in a high PPV, such as a low quantity spot purchase? In the case of favorable PPV, was the company simply fortunate enough to buy at a low price, or does it mean that the standard was not estimated properly? Once the organization determines a root cause, it can answer these questions, make any necessary improvements, and determine the effectiveness of those improvements by comparing PPV before and after the changes.

PPV can be a lagging indicator for the procurement team, comparing how the team performed versus how they were initially expected to perform. However, PPV can also be thought of as a leading indicator. This is because materials with PPV can alert a company to changes in the gross margin (revenue – standard cost – variance) of the product using those materials as well; if a material’s purchase price deviates from the standard, then so will the gross margin of the product. If gross margins are distorted, then this may result in business decisions that are not optimal.

Method Variance

Method Variance is variance that results when the production order for an item does not align with its master data. This variance is recorded in the General Ledger, and the user can find it in the Work Order Cost Report (16.3.4).

Potential Causes of Method Variance

There are several actions that can result in a Method Variance. These include:

- Change in product structure

- Change in routing

- Use of alternate product structures

- Use of alternate routings

- Use of substitute items.

Let’s look at some examples. Suppose an automotive manufacturer uses a part that was not included in the Bill of Materials (BOM); then a material-based Method Variance would result, since the manufacturer used a BOM that did not align with the costed BOM. We can also consider a labor-based method variance. Suppose that normally, the manufacturer uses Line 1 to process cars, but on a certain day, the manufacturer uses Line 2, which takes more time than Line 1, hence more labor is required. This is a Method Variance due to a change in routing.

The Importance of Method Variance

Method Variance tells the company the effects associated with the causes mentioned above. However, a Method Variance could indicate that a configuration correction needs to be made. A manufacturer may find that work orders are getting closed before product structure or routing changes take effect, or cumulative orders are being created before rolling up costs. If these events are happening, correcting these issues will allow the system to accurately calculate the Method Variances as desired.

Manufacturers may ask themselves what behavior they are looking to influence when receiving Method Variances and when. The Method Variance data may indicate that using Production Line 2 instead of Production Line 1 in the previous example resulted in an unfavorable variance. Does the manufacturer want to respond to this data by not using Line 1 when a similar situation occurs in the future? The manufacturer might opt to do this to lower cost, but what if the manufacturer used Line 2 because Line 1 was at full capacity, and they had to fulfill a customer order? A closer analysis could then find that the decision to continue the process on Line 2, despite creating a Method Variance, ultimately led to a favorable financial outcome. Furthermore, perhaps the manufacturer can prepare for similar situations in the future, anticipating when it would or would not be favorable to generate a Method Variance based on supply, demand, and capacity requirements.

Conclusions

We reviewed two important variances within QAD—Purchase Price Variance and Method Variance. We reviewed what they mean, where to find them, their potential causes, and their importance. Both PPV and Method Variance can allow companies to identify potential areas where changes to the process are warranted, and if these changes have the desired outcome when they are implemented. With PPV, we’ve seen how it can cause manufacturers to ask questions such as “Do I need to modify the procurement process?” and “Are my standards estimated properly?”. Similarly, Method Variance allows manufacturers to see the effects of certain changes, such as in product structure or routing, and it can also signal that a configuration correction is warranted. However, companies may wish to plan strategically to identify when it is favorable to create Method Variances.

Next Steps

If you would like to get in touch with the QAD experts at Logan Consulting, please contact us here to find out how we can help grow your business.