Reviews and corrects ledger-to-subledger alignment in D365 by fixing posting configurations, inventory profiles, reconciliation logic, GL mapping, and critical reporting procedures.

Optimizing Financial Operations with Netting in Microsoft Dynamics 365 Finance

Posted on: May 14, 2024 | By: Jarrod Kraemer | Microsoft Dynamics AX/365, Microsoft Dynamics Manufacturing

In the changing landscape of financial technology, Microsoft Dynamics 365 Finance introduces a transformative feature called customer and vendor balance netting. This function streamlines complex financial transactions within companies, serving as a cornerstone for businesses looking to enhance efficiency and optimize cash flow. If you want to read an overview on customer netting, read our blog here!

Understanding Netting in Dynamics 365 Finance

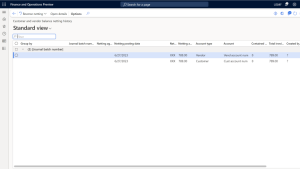

Netting in Dynamics 365 Finance simplifies the financial reconciliation process by allowing businesses to offset balances between entities that are both customers and vendors. Traditionally, businesses would process these transactions separately, incurring additional transaction fees and administrative costs. Netting directly addresses these inefficiencies by consolidating transactions and reducing the financial footprint of maintaining separate ledgers for receivables and payables.

Advantages of Implementing Nettings:

The netting feature in Dynamics 365 Finance offers several key benefits:

Improved Cash Flow Management: By reducing the number of transactions, netting decreases outgoing payments and optimizes cash reserves.

Cost Reduction: Fewer transactions mean fewer bank charges and less administrative burden, directly lowering operational costs.

Enhanced Efficiency: Automated batch jobs manage netting processes periodically, minimizing manual interventions and potential errors.

Core Features and Technical Insights

These are several core aspects of the netting functionality:

Invoice Selection: Dynamics 365 Finance supports netting across various invoice types, including sales, purchase, and project invoices, along with credit and debit notes.

Calculation and Execution: After selecting relevant invoices, Dynamics 365 Finance calculates the correct net amount, considering various factors like discounts and taxes.

Traceability: The system offers robust tools to trace netting transactions and history, ensuring transparency and accountability.

The session also covered advanced scenarios such as cross-currency netting, which accommodates transactions in different currencies, adding flexibility for businesses operating globally.

Setting Up Netting in Dynamics 365 Finance

To leverage netting, companies must establish a netting agreement within Dynamics 365 Finance. This agreement specifies which customer and vendor accounts are eligible for netting, forming the foundation for all netting operations. Proper setup ensures that netting processes are aligned with business rules and regulatory requirements.

Future Roadmap and Enhancements

Dynamics 365 Finance plans to expand netting capabilities to include intercompany netting, which will allow netting across different legal entities. This feature is particularly beneficial for large organizations with multiple subsidiaries. Further enhancements will enable businesses to customize netting operations more granularly, such as tailoring netting rules by invoice criteria or specific account details.

The integration of customer and vendor balance netting into Dynamics 365 Finance marks a significant advancement in financial management technology. By simplifying the reconciliation of accounts receivable and payable, Dynamics 365 Finance helps businesses achieve greater operational efficiency, reduce costs, and improve cash flow management.

Next Steps:

If you want to learn more about customer and vendor netting in Microsoft Dynamics 365 Finance, contact us here to learn how we can help you grow your business. You can also email us at info@loganconsulting.com or call (312) 345-8817.

Related Posts

-

Regulatory Compliance in D365 Finance & Supply Chain: From Risk to Control

Posted on: February 25, 2026

Industrial and manufacturing organizations operate in a regulatory minefield. Indirect tax (sales tax, VAT, GST), SOX-style internal controls, cross-border trade...

-

Order Fulfillment in Industrials: Where Complexity Either Gets Controlled or Multiplied

Posted on: February 23, 2026

In industrial organizations, order fulfillment isn’t a single handoff. It’s a chain reaction. Configured products. Long lead times. Partial shipments....